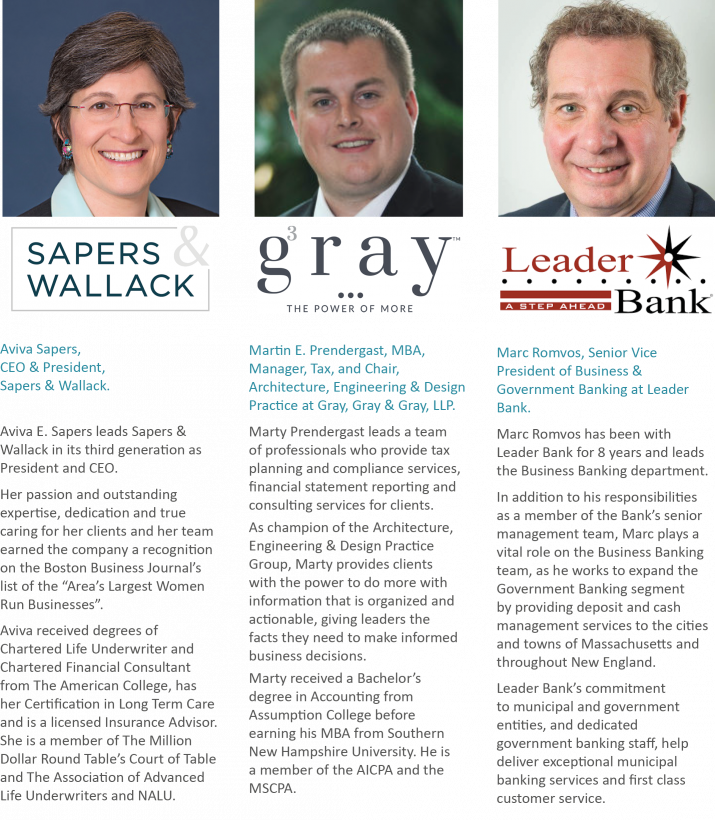

Guest panelist speakers were:

- Martin Prendergast, MBA, Manager, Tax and Chair, Architecture, Engineering & Design Practice Gray, Gray & Gray, LLP.

- Marc Romvos, Senior Vice President of Business & Government Banking at Leader Bank.

Here is a sample of the questions that were addressed.

Technical Accounting Questions:

- Are the calculations different for the 1st draw of PPP loans compared to 2nd draw?

- What should be included in gross receipts for purposes of determining eligibility for a PPP 2nd draw loan?

- What reference period can be used to determine whether my business sustained a 25% or more decline in gross receipts?

- What documentation must I provide to prove the gross receipts drop? And is it true I don’t need to send this now if I am requesting less than $150,000?

- Are there any special considerations for restaurants and hotels to go for more money?

- I heard additional expense categories are now allowed – what are they?

SBA Lender Questions:

- Does my 1st PPP loan draw need to be forgiven in order to get the 2nd draw?

- What are the eligibility differences between the 1st and 2nd draws of the PPP loan?

- What is the application window for the 2nd draw of the PPP loan?

- Has the new bill amended any of the forgiveness guidance on the 1st round of PPP funding?

- What information will I need to complete my application?

- Do I have to use the same bank for the 2nd draw of the PPP loan as I did for the 1st one?

PANELIST:

Webinar content is intended for educational purposes only. Webinars provide a brief summary based on our understanding and interpretation of current law. All tax references are to federal tax law only, unless otherwise stated. The information contained in the webinars is general in nature and is based on authorities that are subject to change. It is not, and should not be construed as accounting, legal or tax advice or opinion provided by Gray, Gray & Gray, LLP. The material presented may not be applicable to, or suitable for, specific circumstances or needs, and may require consideration of non-tax factors and tax factors not described herein. Contact Gray, Gray & Gray or another tax professional prior to taking any action based upon this information. Changes in tax laws or other factors could affect, on a prospective or retroactive basis the information contained herein; Gray, Gray & Gray assumes no obligation to inform the reader/webinar attendee of any such changes. The material presented is not intended to, and cannot be used to, avoid IRS penalties. This material supports the marketing and promotion of accounting services. Seek advice based on your particular circumstances from independent tax, legal accounting, insurance, investment and financial advisors.