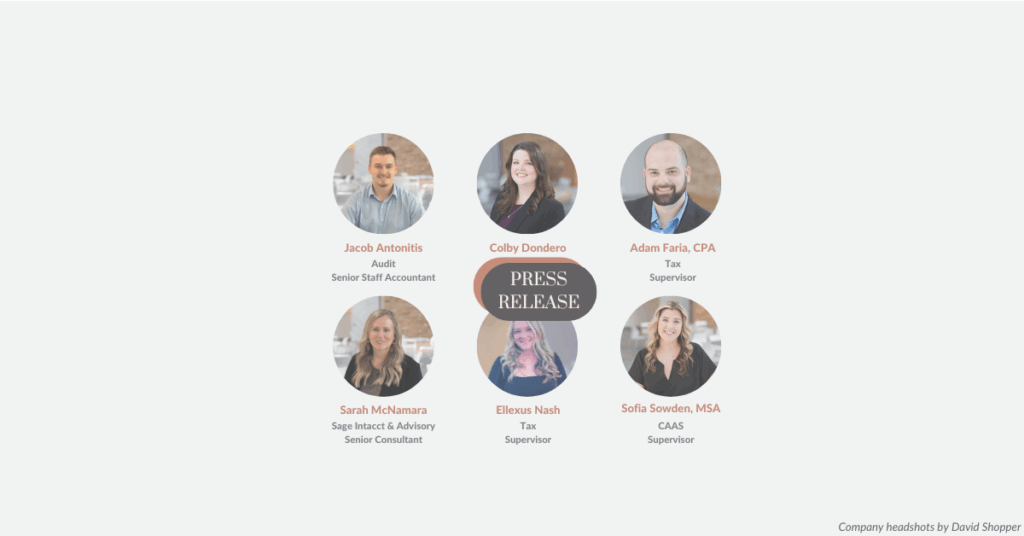

Gray, Gray, & Gray Elevates Six to New Roles

Canton, MA (July 1, 2025): Gray, Gray & Gray, LLP, a business consulting and accounting firm based in Canton, MA, has announced the promotion of six team members to new positions: Jacob Antonitis has been promoted to Senior Staff Accountant in the Audit & Assurance department. He is a graduate of St. Anselm College. Colby […]

Gray, Gray, & Gray Elevates Six to New Roles Read More »